Wow, what a week so far. The cat’s away, but it means this mouse has a ton more work to do to cover. Sorry that you’re just getting this now.

I’ve been through a lot of houses in my day. Growing up, with both my mom and grandmother in the industry, I spent a lot of time in model homes. Granted, most of that time was spent being bored out of my skull, but it probably skewed my expectations of what homes were supposed to look like.

Not every home can be a model home. We don’t all have the money to hire designers, stagers and other “make it look pretty” specialists. Some day I’ll do a post explaining the merits of using these folks when it comes time to sell, but that’s for another day.

Whenever someone lists their home for sale, a good agent will spend some time advising them of the little things they can do to make their home more saleable. The number one item on said list is, almost always, tidying up. A clean home will always show better than a messy one, and if nothing else, will keep the potential buyer in a pleasant mood walking through your place. It doesn’t have to show like those model homes, most buyers won’t have that expectation. It should however, look like something someone would want to buy.

So what happens when you’re selling a home that you don’t live in? Landlords put a lot of trust in their tenants to make their living quarters show-worthy. And from experiences, tenants couldn’t give less of a damn.

It’s one thing to keep a clean house because you should. It’s much more enjoyable: Fresh smells, open space, readiness to entertain when the mood strikes, etc. If that’s not your thing, fine, understood, we all let our place go here and there.

It’s another thing altogether when the person whose house you’re living in asks you to do them a solid and you blatantly disregard their request. I mean hey, if you pay your $400 bucks for a summer room, you should get to do whatever you want, that’s what the $400’s for right? Put a hole in a wall or two, slap up some Element stickers on your bedroom door, go to town. (Sidenote: Show of hands for anyone who’s seen stickers on a door/wall/window and been like, “Wow, that looks great, I should definitely do that”.) It’s an absolute disgrace what some of these tenants do, and it’s probably going to mean that the houses we saw won’t be moving any time soon.

So here are two houses I’ve seen this week:

The University House, Waterloo

This thing was as a pure a student ghetto hellhole as I’ve seen. I got to tour student rentals a ton in university, and this thing took the cake. Great price for fully licensed, registered duplex, but no MLS pictures- sign number 1 that this wasn’t going to be a great time. If you’ve got nothing to hide, you’re definitely putting pictures of the place on MLS, so let’s suffice to say that I wasn’t going to be blown away the interior.

Well I was, but not in a great way. After knocking (tenants may or may not be home), I let myself in with the key from the lockbox. Announced myself. Nothing. Okay, we’re good to go here.

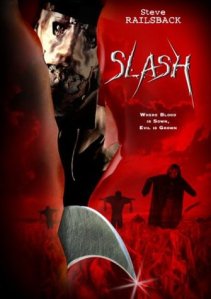

First room- Living room. Great size. They’ve got 4 chairs huddled around a little flat screen and two couches on either side of a coffee table. At least I think it was a coffee table, it was covered in garbage that I didn’t really notice because my eyes were drawn to 2 things. The first, this hunting knife in a sleeve. Terrifying on it’s own.

Super terrifying on a stack of movies like Slash.

Welcome to our home! Stay a while?

Yeah, okay. It’s at this point that I’m torn between how utterly ridiculous and amazing it is to find this chilling on someone’s coffee table, and how I should’ve been an accountant, never finding myself here in the first place.

Sure enough, now I hear footsteps. I’m kidding myself right? I mean, totally psyching myself out after seeing this stuff. I turn around to the doorway on the right. It’s the kitchen. Through the doorway on the wall is a rack. A rack of more knives. Just hanging there, waiting for whoever’s making these footsteps to come put them to good use.

At this point I’ve noticed 3 things: the living room layout, The Stabber’s Beginners Kit, and a wall of knives he can graduate up to.

Fun. And now footsteps guy peeks around the corner.

“Hey,” says a lanky kid with glasses. Anticlimactic as anything.

“Uh, hey, how’s it going chief? Just here for the 11 o’clock showing, mind if I look around?”

“I guess. The one guy’s bedroom’s locked, and the other guy’s in the shower.”

Awesome. Hey, I gave you guys about 40 hours’ notice I was coming and you picked now to shower? And your pal couldn’t leave the door open? Great. I quickly learn that there are 6 rooms on this floor, and I can’t see a third of them.

I get the idea from the 4 I can see and make my way downstairs to the shared laundry. A fairly new washer and dryer are a nice surprise. +1. (I think that brings us to -12)

I knock entering the second unit downstairs. Guy pops out of his pitch black room asking if he can help me. Obviously didn’t get the memo. Not only that, but he goes back in after announcing himself and closes the door. Just going to assume that room was a palace and move on. The “kitchen” downstairs -which the listing said included a stove- had no stove. A microwave and a sink. A Kraft Dinner maker and some water to wash your bowl with.

Two more bedrooms painted in kindergarten green and I was over this place. Not something my customer was looking for. There wasn’t a living room in the basement, which makes it harder to rent to groups anyway. For as awful as the house was, the guys inside it could’ve cleaned up, and at the very least, not done their best to creep the hell out of me.

A great introduction to the world of showing student rentals to say the least.

The Off-Scottsdale Rental, Guelph

I can’t say exactly where this house is, given that it’s still on the market, but it’s in a primarily student-rental neighbourhood off of Scottsdale in Guelph. I showed it Tuesday night… in the pouring rain…with the wrong lockbox combination. Needless to say, after 2 phone calls and 5 minutes in the downpour, we were already regretting our decision to take a look. It didn’t get a whole lot better from there.

The house was an exact replica of my first student house on Sidney Cres., which was nice in that I’d know where everything was. We started the main floor tour in the kitchen, lined with next-to-empty 40’s of bargain bin liquor. I guess when you live close to an LCBO but not a Beer Store, the bottles tend to pile up. You can get them easily but it’s just such an inconvenience to take them anywhere, let alone just recycle.

The rest of the main floor was pretty vanilla, so we knocked on the basement door. Just music. Knock again.

“WHAT?”

“Oh, hey, just here for the showing.” I turn to my client who’s thinking exactly the same thing: Upstairs first.

Luckily the upstairs did the trick.

The first room, a bathroom, was quite the treat. I never quite understood how people lived with toilet paper scraps all over the floor or, for that matter, how they get there in the first place. Is it sheer boredom? The only thing worth doing while you’re on the john is tearing up paper and littering your floor? That’s what Angry Birds and Fruit Ninja were designed specifically for.

This. Pretty much.

There was a bedroom with nothing in it; a second bedroom with sheets and a few cases worth of Pure Life bottles scattered all over; and a third bedroom, locked, with a TV clearly audible and nobody willing to let us in. Grand.

This place had a great backyard and the deck was custom-built to fit a hot tub, which was noticeably absent. Ultimately it was shame that my buyer didn’t like the house, because the lot and layout would’ve been fantastic.

Sometimes it’s hard to see past cosmetics. It’s always hard to buy something you can’t even see. Put them together, and the recipe for the sale isn’t there 9 times out of ten. It’s like accidentally using salt instead of sugar. It’s disappointing and leaves a bad taste in your mouth.