“Home ownership is too costly.”

“We don’t make enough money.”

“Banks are biased against us.”

Regardless of validity, the reasons against ownership for young people are numerous. Despite them however, more and more are defying the excuses and converting their hard-earned paycheques into a piece of property to call their own.

More and more young people are buying houses & condos, despite narratives to the contrary. From: The Globe & Mail

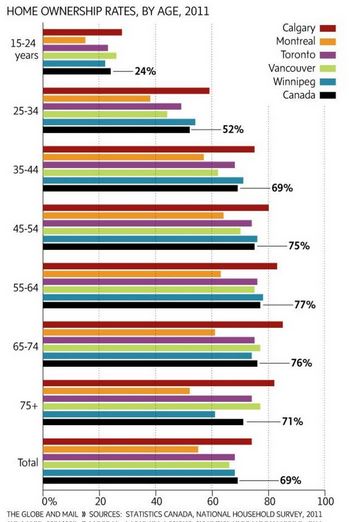

It’s a good thing they are too, as rates of home ownership tend to decline after age 65. While our demographics shift toward an older population, young buyers will be expected to fill that void. An inability to do so long-term could create a vast housing surplus, and drop property values across the board. So far though, it seems that the under-25 crowd are keeping things heading in the right direction.

Over the past decade and beyond, home values in some of the major urban cores have skyrocketed as land scarcity and foreign investment have pushed housing demand ever higher. It pits buyers of all kinds, especially young buyers with less accrued equity, in a tight spot. They’re being forced to compete with foreign, cash buyers using the Canadian real estate market as their own personal piggy bank, outside the grasp of their communist governments. Naturally, t’s a one-sided fight.

That said, in smaller markets, housing remains substantially more affordable; and the goal of home ownership much more attainable than the general overlying narrative. Furthermore, if buyers in Vancouver, Toronto and Montreal can buck the trend, then the same should be true across the board.

I hear people my age talk a lot about how expensive housing is, and what they don’t often consider is that there are landlords out there making positive cash flows off of them. In select instances, a landlord can lump mortgage costs, insurance and taxes together and still take his family out for a steak dinner on a tenant’s rent. So why then, aren’t young people more proactive about it?

Overall, we are finally catching on. In fact, home ownership among the youngest share of the population (Under 25’s) rose by 4% from 2006 to 2011 and now remains around 25% from the graphic above. To buyers’ benefits, price growth was minimally stunted by the US recession, aiding in affordability. However these gains come despite consistent upward price movement from the big 3 Canadian cities, and in ignorance of decreased affordability in those markets.

How is this possible?

Having established that, counter-intuitively, this generation’s ownership share’s been growing; it’s key to take a look at how. The biggest contributors are buyers’ parents, who are pitching in with down-payments more than ever before. From 2010-2014, first-time homebuyers received about 11% of down payments as gifts from family members, with another 6% coming from personal loans from family members. Though the loan share was unchanged from 2000-2004, the gifted portion is about 5% higher than 10 years ago. With average down payments equaling about 21% on first-time purchases, that 17% figure amounts to $10,080 on your average $300,000 home. For perspective, the house my grandparents bought in 1970 set them back a measly $10k to own it outright, so I guess $10,000 gifts are peanuts. It is understandable though that with the rise in values we’ve, the help from the folks is almost necessary to sustain the goals of today’s young shopper, and given that it’s been the parent’s houses who’ve seen the growth, we know the equity is there to be able to make these gifts, generally speaking.

As parents’ aid pushes demand from D1 to D2, both the quantity demanded and the market price rise, furthering the handicap for those without family funding.

At the same time, parents are artificially fueling the fire. By adding $10,000 to the budgets of a growing market share, parents are effectively promoting the ballooning of home prices. As illustrated here, these gifts that young buyers are stumbling into is resulting in more buyers entering the market, and buyers’ budgets being greater than they might otherwise be. This in itself creates a bit of a dangerous predicament, since some buyers are being aided by their parents while others are not, and this price shift pushes the latter further from their ownership goals. The Canadian Association of Accredited Mortgage Professionals disputes the impact that parents are having on prices, but consider this: With 1/3 of 18- to 35-year olds who haven’t bought a home attributing the decision to waiting for prices to drop; how will they ever drop if parents keep pumping in money? Answer: They won’t. Even if you don’t have the help, use parents supporting the market as a way to make your house purchase work for you.

Housing is like any investment. You have to pay to play, and you’re not going to make a cent off of it unless you buy something. The people that complain certain stocks are too expensive are the ones who sat on the sideline didn’t buy in when they were affordable. There are elements of risk involved, but you can continue to pay rent to a landlord or you can cut out other expenses to make home ownership a reality. It’s a decision that more and more young people are making sacrifices to pursue. And I can’t blame them for a second.

With statistics from (Links in post):

“How young Vancouver buyers are crashing the real estate party”, Frances Bula, Globe and Mail, October 17, 2014.

“1st time home buyers get more family help for down payment”, CBC News, November 18, 2014.